Estate planning

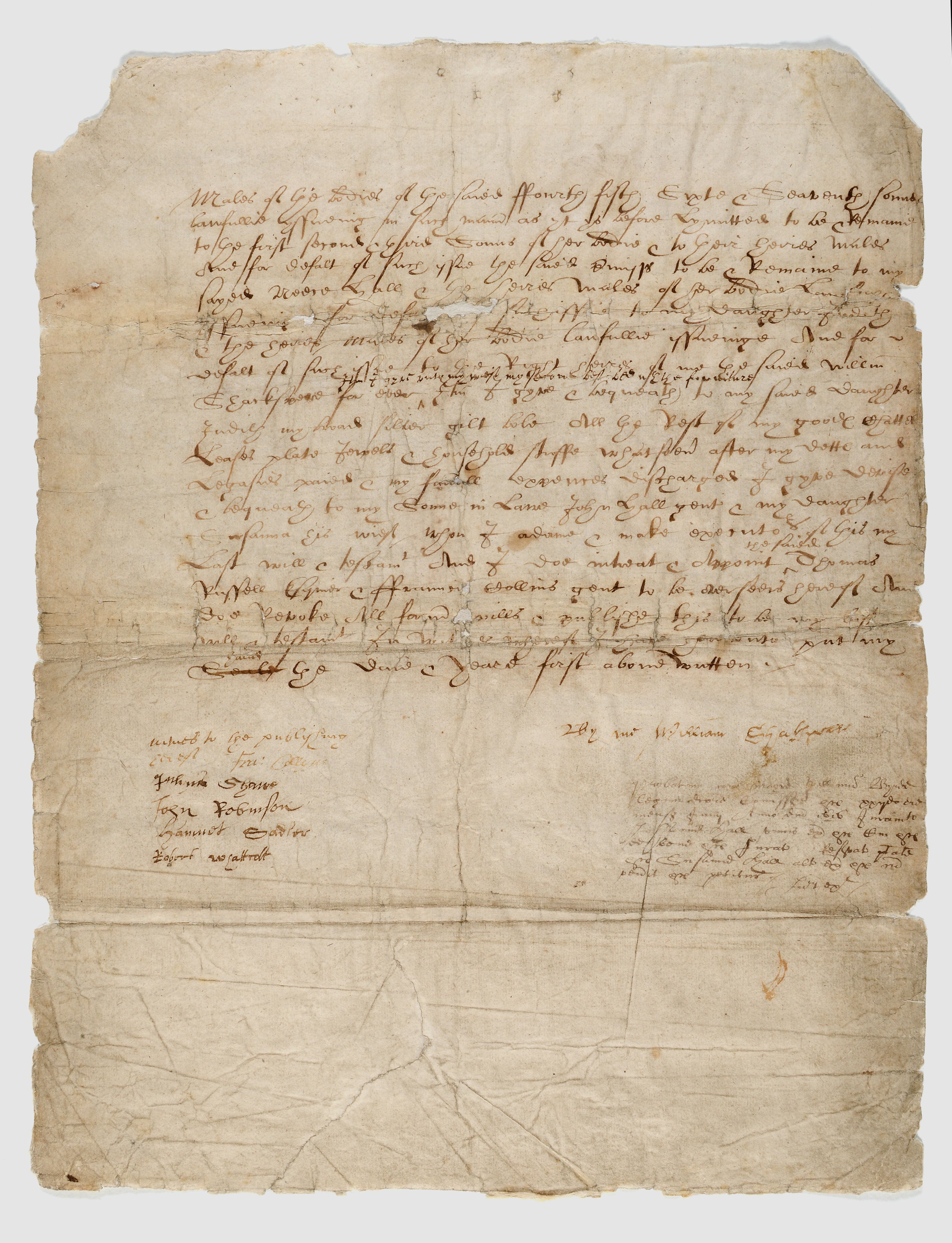

Estate planning is the process of anticipating and arranging for the management and disposal of a person's estate during the person's life in preparation for a person's future incapacity or death. The planning includes the bequest of assets to heirs, loved ones, and/or charity, and may include minimizing gift, estate, and generation-skipping transfer taxes.[1][2][3] Estate planning includes planning for incapacity, reducing or eliminating uncertainties over the administration of a probate, and maximizing the value of the estate by reducing taxes and other expenses. The ultimate goal of estate planning can only be determined by the specific goals of the estate owner, and may be as simple or complex as the owner's wishes and needs directs. Guardians are often designated for minor children and beneficiaries with incapacity.[4]

Worldwide[edit]

Malaysia[edit]

In West Malaysia and Sarawak, wills are governed by the Wills Act 1959. In Sabah, the Will Ordinance (Sabah Cap. 158) applies. The Wills Act 1959 and the Wills Ordinance applies to non-Muslims only.[12] Section 2(2) of the Wills Act 1959 states that the Act does not apply to wills of persons professing the religion of Islam.[12] For Muslims, inheritance will be governed under Syariah Law where one would need to prepare Syariah compliant Islamic instruments for succession.

Section 2 of the Wills Act 1959[12] defines a will as a 'declaration intended to have legal effect of the intentions of a testator with respect to his property or other matters which he desires to be carried into effect after his death and includes a testament, a codicil and an appointment by will or by writing in the nature of a will in exercise of a power and also a disposition by will or testament of the guardianship, custody and tuition of any child'.[12]