Mechanism design

Mechanism design is a branch of economics, social choice theory, and game theory that deals with designing games (or mechanisms) to implement a given social choice function. Because it starts at the end of the game (the optimal result) and then works backwards to find a game that implements it, it is sometimes called reverse game theory.

Mechanism design has broad applications, including traditional domains of economics such as market design, but also political science (through voting theory) and even networked systems (such as in inter-domain routing).[1]

Mechanism design studies solution concepts for a class of private-information games. Leonid Hurwicz explains that "in a design problem, the goal function is the main given, while the mechanism is the unknown. Therefore, the design problem is the inverse of traditional economic theory, which is typically devoted to the analysis of the performance of a given mechanism."[2]

The 2007 Nobel Memorial Prize in Economic Sciences was awarded to Leonid Hurwicz, Eric Maskin, and Roger Myerson "for having laid the foundations of mechanism design theory."[3] The related works of William Vickrey that established the field earned him the 1996 Nobel prize.

Intuition[edit]

In an interesting class of Bayesian games, one player, called the "principal", would like to condition his behavior on information privately known to other players. For example, the principal would like to know the true quality of a used car a salesman is pitching. He cannot learn anything simply by asking the salesman, because it is in the salesman's interest to distort the truth. However, in mechanism design, the principal does have one advantage: He may design a game whose rules influence others to act the way he would like.

Without mechanism design theory, the principal's problem would be difficult to solve. He would have to consider all the possible games and choose the one that best influences other players' tactics. In addition, the principal would have to draw conclusions from agents who may lie to him. Thanks to the revelation principle, the principal only needs to consider games in which agents truthfully report their private information.

Foundations[edit]

Mechanism[edit]

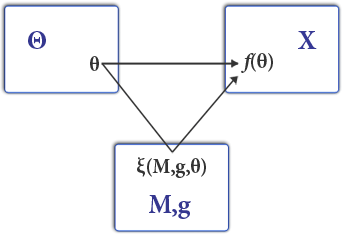

A game of mechanism design is a game of private information in which one of the agents, called the principal, chooses the payoff structure. Following Harsanyi (1967), the agents receive secret "messages" from nature containing information relevant to payoffs. For example, a message may contain information about their preferences or the quality of a good for sale. We call this information the agent's "type" (usually noted and accordingly the space of types ). Agents then report a type to the principal (usually noted with a hat ) that can be a strategic lie. After the report, the principal and the agents are paid according to the payoff structure the principal chose.

The timing of the game is:

Examples[edit]

Price discrimination[edit]

Mirrlees (1971) introduces a setting in which the transfer function t() is easy to solve for. Due to its relevance and tractability it is a common setting in the literature. Consider a single-good, single-agent setting in which the agent has quasilinear utility with an unknown type parameter