Reaganomics

Reaganomics (/reɪɡəˈnɒmɪks/; a portmanteau of Reagan and economics attributed to Paul Harvey),[1] or Reaganism, were the neoliberal[2][3][4] economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents,[5] while Reagan and his advocates preferred to call it free-market economics.

Not to be confused with Reaganism.

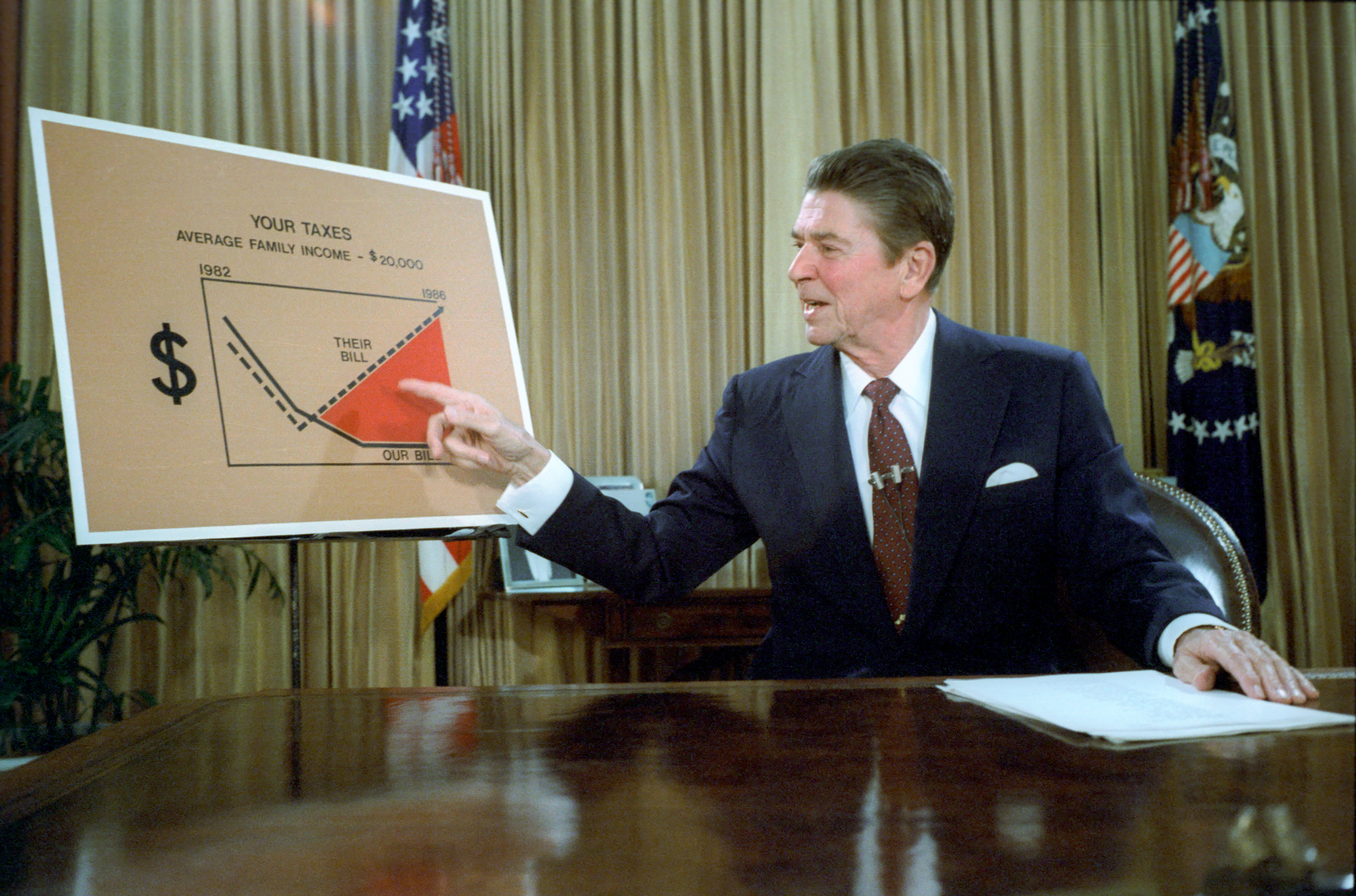

The pillars of Reagan's economic policy included increasing defense spending, balancing the federal budget and slowing the growth of government spending, reducing the federal income tax and capital gains tax, reducing government regulation, and tightening the money supply in order to reduce inflation.[6]

The results of Reaganomics are still debated. Supporters point to the end of stagflation, stronger GDP growth, and an entrepreneurial revolution in the decades that followed.[7][8] Critics point to the widening income gap, what they described as an atmosphere of greed, reduced economic mobility, and the national debt tripling in eight years which ultimately reversed the post-World War II trend of a shrinking national debt as percentage of GDP.[9][10]