Revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.[1] Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees.[2] "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, revenue is a subsection of the Equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses).[3]

For other uses, see Revenue (disambiguation).

In general usage, revenue is the total amount of income by the sale of goods or services related to the company's operations. Sales revenue is income received from selling goods or services over a period of time. Tax revenue is income that a government receives from taxpayers. Fundraising revenue is income received by a charity from donors etc. to further its social purposes.

In more formal usage, revenue is a calculation or estimation of periodic income based on a particular standard accounting practice or the rules established by a government or government agency. Two common accounting methods, cash basis accounting and accrual basis accounting, do not use the same process for measuring revenue. Corporations that offer shares for sale to the public are usually required by law to report revenue based on generally accepted accounting principles or on International Financial Reporting Standards.

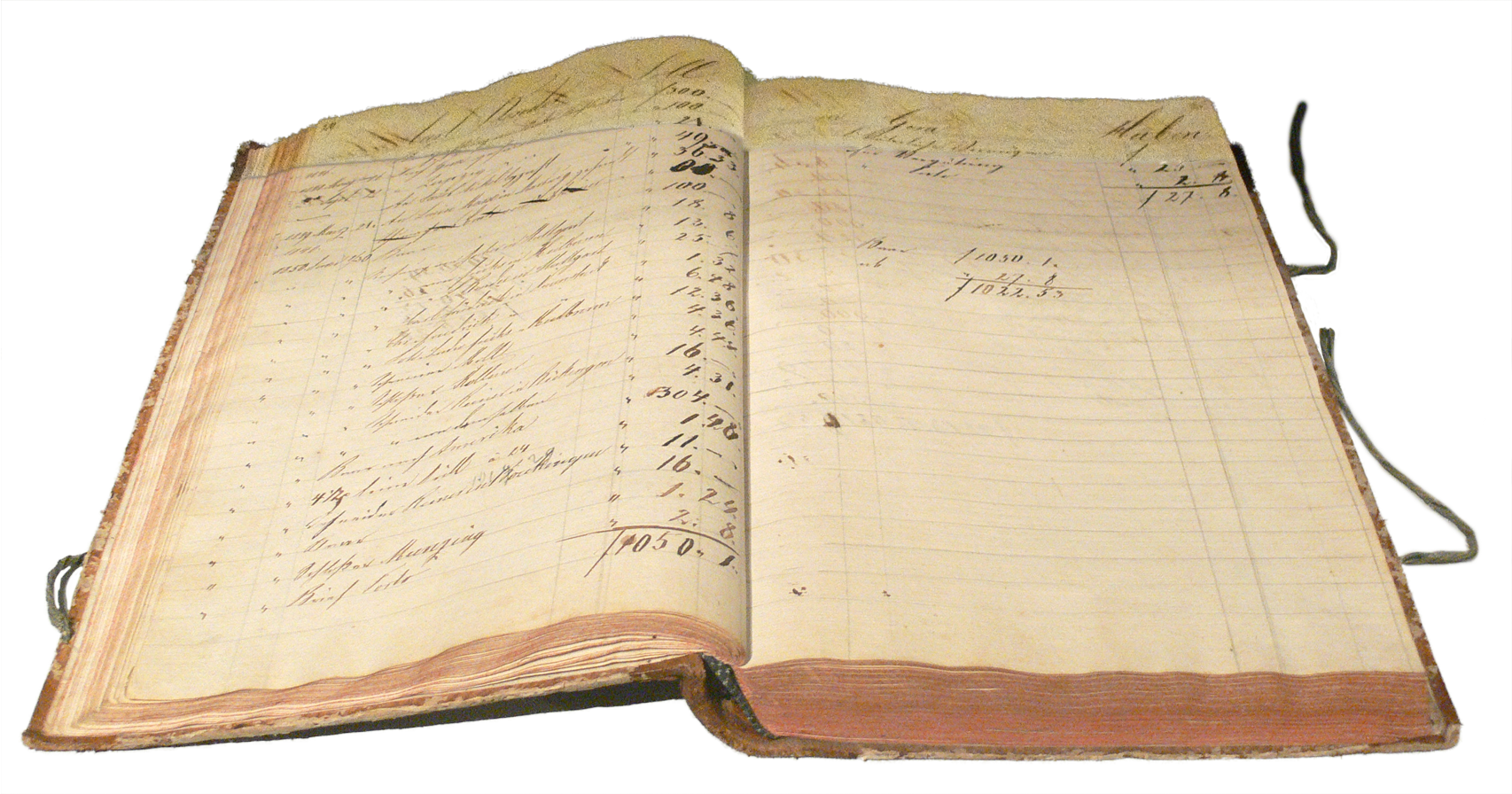

In a double-entry bookkeeping system, revenue accounts are general ledger accounts that are summarized periodically under the heading "Revenue" or "Revenues" on an income statement. Revenue account-names describe the type of revenue, such as "repair service revenue", "rent revenue earned" or "sales".[4]