Tendency of the rate of profit to fall

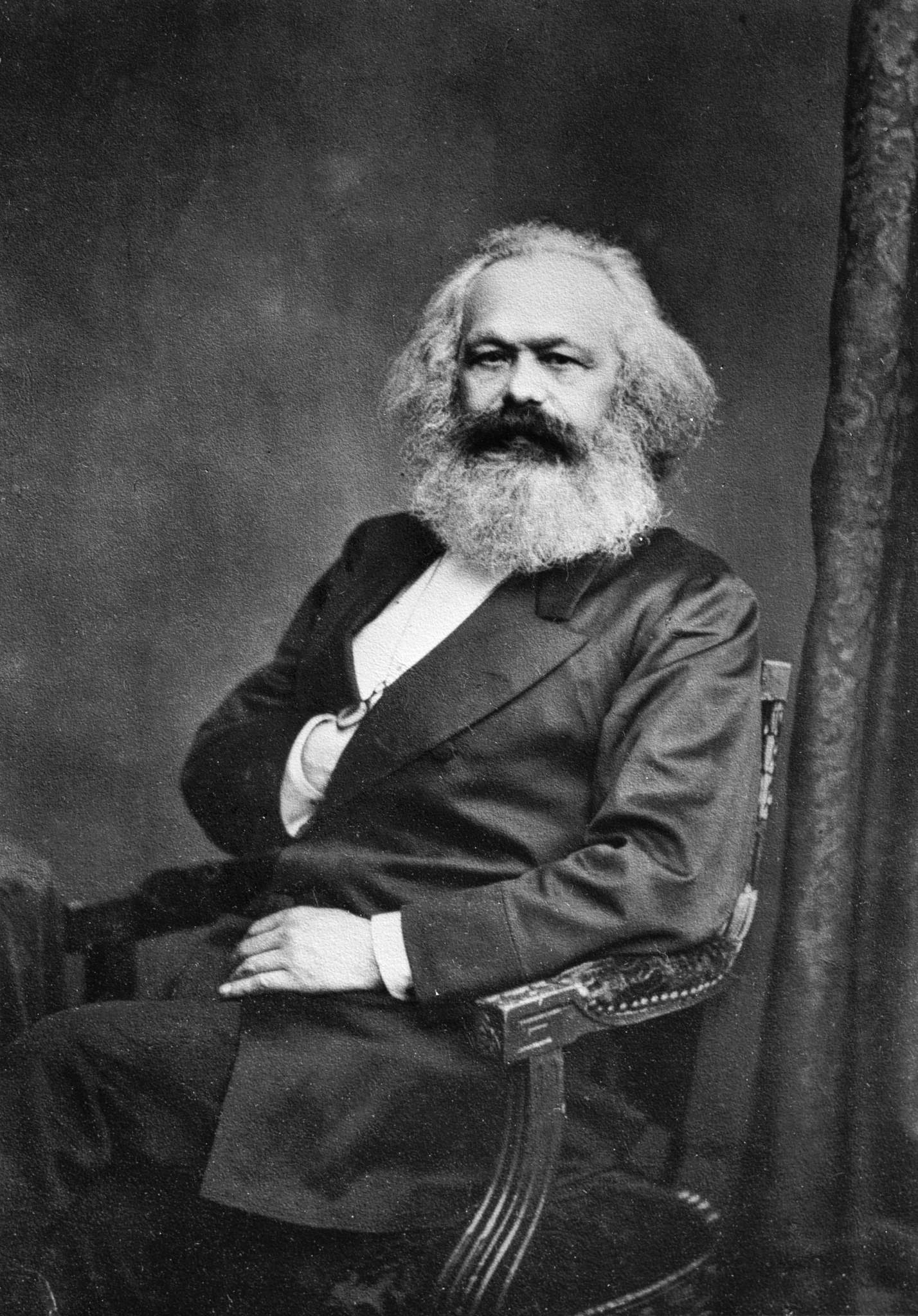

The tendency of the rate of profit to fall (TRPF) is a theory in the crisis theory of political economy, according to which the rate of profit—the ratio of the profit to the amount of invested capital—decreases over time. This hypothesis gained additional prominence from its discussion by Karl Marx in Chapter 13 of Capital, Volume III,[1] but economists as diverse as Adam Smith,[2] John Stuart Mill,[3] David Ricardo[4] and William Stanley Jevons[5] referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.[6]

Geoffrey Hodgson stated that the theory of the TRPF "has been regarded, by most Marxists, as the backbone of revolutionary Marxism. According to this view, its refutation or removal would lead to reformism in theory and practice".[7] Stephen Cullenberg stated that the TRPF "remains one of the most important and highly debated issues of all of economics" because it raises "the fundamental question of whether, as capitalism grows, this very process of growth will undermine its conditions of existence and thereby engender periodic or secular crises."[8]

Causal explanations[edit]

Karl Marx[edit]

In Marx's critique of political economy, the value of a commodity is the medium amount of labour that is socially necessary to produce that commodity. Marx argued that technological innovation enabled more efficient means of production. In the short run, physical productivity would increase as a result, allowing the early adopting capitalists to produce greater use values (i.e., physical output). In the long run, if demand remains the same and the more productive methods are adopted across the entire economy, the amount of labour required (as a ratio to capital, i.e. the organic composition of capital) would decrease. Now, assuming value is tied to the amount of labor necessary, the value of the physical output would decrease relative to the value of production capital invested. In response, the average rate of industrial profit would therefore tend to decline in the longer term.

Empirical research[edit]

Before 1970[edit]

In the 1870s, Marx certainly wanted to test his theory of economic crises and profit-making econometrically,[61] but adequate macroeconomic statistical data and mathematical tools did not exist to do so.[62] Such scientific resources began to exist only half a century later.[63]

In 1894, Friedrich Engels did mention the research of the émigré socialist Georg Christian Stiebeling, who compared profit, income, capital and output data in the U.S. census reports of 1870 and 1880, but Engels claimed that Stiebeling explained the results "in a completely false way" (Stiebeling's defence against Engels's criticism included two open letters submitted to the New Yorker Volkszeitung and Die Neue Zeit).[64] Stiebeling's analysis represented "almost certainly the first systematic use of statistical sources in Marxian value theory."[65]

Although Eugen Varga[66][67] and the young Charles Bettelheim[68][69] already studied the topic, and Josef Steindl began to tackle the problem in his 1952 book,[70] the first major empirical analysis of long-term trends in profitability inspired by Marx was a 1957 study by Joseph Gillman.[71] This study, reviewed by Ronald L. Meek and H. D. Dickinson,[72] was extensively criticized by Shane Mage in 1963.[73] Mage's work provided the first sophisticated disaggregate analysis of official national accounts data performed by a Marxist scholar.

After 1970[edit]

There have been a number of non-Marxist empirical studies of the long-term trends in business profitability.[74]

Particularly in the late 1970s and early 1980s, there were concerns among non-Marxist economists that the profit rate could be really falling.[75]

Various efforts have been conducted since the 1970s to empirically examine the TRPF. Studies supporting it include those by Michael Roberts,[76][77] Themistoklis Kalogerakos,[78] Minqi Li,[79] John Bradford,[80] and Deenpankar Basu (2012).[81] Studies contradicting the TRPF include those by Òscar Jordà,[82] Marcelo Resende,[83] and Simcha Barkai.[84] Other studies, such as those by Basu (2013),[85] Elveren,[86] Thomas Weiß[87] and Ivan Trofimov,[88] report mixed results or argue that the answer is not yet certain due to conflicting findings and issues with appropriately measuring the TRPF.

From time to time, the research units of banks and government departments produce studies of profitability in various sectors of industry.[89] The Office for National Statistics releases company profitability statistics every quarter, showing increasing profits.[90] In the UK, Ernst & Young (EY) nowadays provide a Profit Warning Stress Index for quoted companies.[91] The Share Centre publishes the Profit Watch UK Report.[92] In the US, Yardeni Research provides a briefing on S&P 500 profit margin trends, including comparisons with NIPA data.[93]