In absolute terms, affluence is a relatively widespread phenomenon in the United States, with over 30% of households having an income exceeding $100,000 per year and over 30% of households having a net worth exceeding $250,000, as of 2019.[2][3] However, when looked at in relative terms, wealth is highly concentrated: the bottom 50% of Americans only share 2% of total household wealth while the top 1% hold 35% of that wealth.

In the United States, as of 2019, the median household income is $60,030 per year and the median household net worth is $97,300, while the mean household income is $89,930 per year and the mean household net worth is $692,100.[2][3]

Affluence in the United States has been attributed in many cases to inherited wealth amounting to "a substantial head start":[8][9] in September 2012, the Institute for Policy Studies found that over 60 percent of the Forbes richest 400 Americans had grown up in the top 5% of households.[10]

Income is commonly used to measure affluence, although this is a relative indicator: a middle class person with a personal income of $77,500 annually and a billionaire may both be referred to as affluent, depending on reference groups. An average American with a median income of $32,000[11] ($39,000 for those employed full-time between the ages of 25 and 64)[12] when used as a reference group would justify the personal income in the tenth percentile of $77,500 being described as affluent,[11] but if this earner were compared to an executive of a Fortune 500 company, then the description would not apply.[13][14] Accordingly, marketing firms and investment houses classify those with household incomes exceeding $250,000 as mass affluent, while the threshold upper class is most commonly defined as the top 1% with household incomes commonly exceeding $525,000 annually.

According to the U.S. Census Bureau, 42% of U.S. households have two income earners, thus making households' income levels higher than personal income levels;[15] the percent of married-couple families with children where both parents work is 59.1%.[16]

In 2005, the economic survey revealed the following income distribution for households and individuals:

Households may also be differentiated among each other, depending on whether or not they have one or multiple income earners (the high female participation in the economy means that many households have two working members[19]). For example, in 2005 the median household income for a two income earner households was $67,000 while the median income for an individual employed full-time with a graduate degree was in excess of $60,000, demonstrating that nearly half of individuals with a graduate degree have earnings comparable with most dual income households.[12]

Overall, the term affluent may be applied to a variety of individuals, households, or other entities, depending on context. Data from the U.S. Census Bureau serves as the main guideline for defining affluence. U.S. government data not only reveal the nation's income distribution but also the demographic characteristics of those to whom the term "affluent", may be applied.[15]

Changes in wealth[edit]

1989–2001[edit]

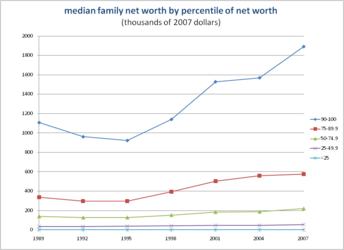

When observing the changes in the wealth among American households, one can note an increase in wealthier individuals and a decrease in the number of poor households, while net worth increased most substantially in semi-wealthy and wealthy households. Overall the percentage of households with a negative net worth (more debt than assets) declined from 9.5% in 1989 to 4.1% in 2001.[20]

The percentage of net worths ranging from $500,000 to one million doubled while the percentage of millionaires tripled.[20] From 1995 to 2004, there was tremendous growth among household wealth, as it nearly doubled from $21.9 trillion to $43.6 trillion, but the wealthiest quartile of the economic distribution made up 89% of this growth.[23] During this time frame, wealth became increasingly unequal, and the wealthiest 25% became even wealthier.

According to U.S. Census Bureau statistics, this 'upward shift' is most likely the result of a booming housing market which caused homeowners to experience tremendous increases in home equity. Life-cycles have also attributed to the rising wealth among Americans. With more and more baby-boomers reaching the climax of their careers and the middle-aged population making up a larger segment of the population now than ever before, more and more households have achieved comfortable levels of wealth.[20] Zhu Xiao Di (2004) notes, that household wealth usually peaks around families headed by people in their 50s, and as a result, the baby boomer generation reached this age range at the time of the analysis.[23]

After 2007[edit]

Household net worth fell from 2007 to 2009 by a total of $17.5 trillion or 25.5%. This was the equivalent loss of one year of GDP.[63]

By the fourth quarter of 2010, the household net worth had recovered by a growth of 1.3 percent to a total of $56.8 trillion. An additional growth of 15.7 percent is needed just to bring the value to where it was before the recession started in December 2007.[22] In 2014 a record breaking net worth of $80.7 trillion was achieved.[64]

The income disparities even within the top 1.5% are quite drastic.[65] While households in the top 1.5% of households had incomes exceeding $250,000, 443% above the national median, their incomes were still 2200% lower than those of the top 0.1% of households.

Religion[edit]

Individuals of a broad variety of religious backgrounds have become wealthy in America. However, the majority of these individuals follow Mainline Protestant denominations; Episcopalians[77] and Presbyterians are most prevalent.[78] According to a 2016 study by the Pew Research Center, Jewish again ranked as the most financially successful religious group in the United States, with 44% of Jews living in households with incomes of at least $100,000, followed by Hindu (36%), Episcopalians (35%), and Presbyterians (32%).[79] Owing to their numbers, more Catholics (13.3 million) reside in households with a yearly income of $100,000 or more than any other religious group.[79]

According to the same study there is a correlation between education and income, about 77% of American Hindus have an undergraduate degree and according to a study in 2020, they are earning the highest with median income $137,000, followed by Jews (59%), Episcopalians (56%), and Presbyterians (47%).[80]

The total value of all U.S. household wealth in 2000 was approximately $44 trillion. Prior to the Late-2000s recession which began in December 2007 its value was at $65.9 trillion. After, it plunged to $48.5 trillion during the first quarter of 2009. The total household net worth rose 1.3% by the fourth quarter of 2009 to $54.2 trillion, indicating the American economy is recovering.

Wealth:

Tax avoidance:

General: