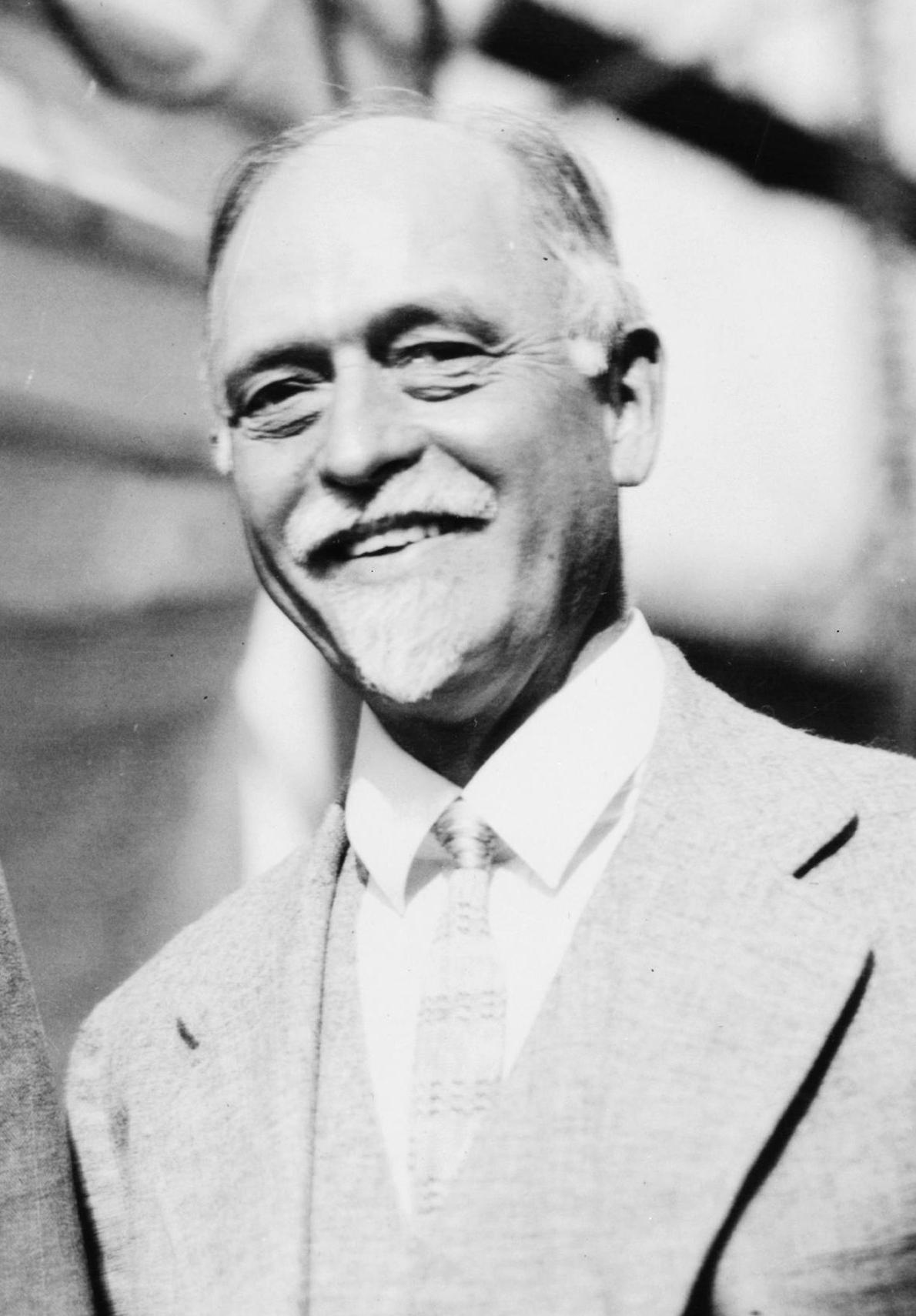

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947)[1] was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school.[2] Joseph Schumpeter described him as "the greatest economist the United States has ever produced",[3] an assessment later repeated by James Tobin[4] and Milton Friedman.[5]

Irving Fisher

February 27, 1867

April 29, 1947 (aged 80)

American

Yale University (BA, PhD)

Fisher made important contributions to utility theory and general equilibrium.[6][7] He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates.[4] His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism".[8] Fisher was also a pioneer of econometrics, including the development of index numbers. Some concepts named after him include the Fisher equation, the Fisher hypothesis, the international Fisher effect, the Fisher separation theorem and Fisher market.

Fisher was perhaps the first celebrity economist, but his reputation during his lifetime was irreparably harmed by his public statement, just nine days before the Wall Street Crash of 1929, that the stock market had reached "a permanently high plateau". His subsequent theory of debt deflation as an explanation of the Great Depression, as well as his advocacy of full-reserve banking and alternative currencies, were largely ignored in favor of the work of John Maynard Keynes.[4] Fisher's reputation has since recovered in academic economics, particularly after his theoretical models were rediscovered in the late 1960s to the 1970s, a period of increasing reliance on mathematical models within the field.[4][9][10] Interest in him has also grown in the public due to an increased interest in debt deflation after the Great Recession.[11]

Fisher was one of the foremost proponents of the full-reserve banking, which he advocated as one of the authors of A Program for Monetary Reform where the general proposal is outlined.[12][13]

Biography[edit]

Fisher was born in Saugerties, New York. His father was a teacher and a Congregational minister, who raised his son to believe he must be a useful member of society. Despite being raised in religious family, he later on became an atheist.[14] As a child, he had remarkable mathematical ability and a flair for invention. A week after he was admitted to Yale College his father died, at age 53. Irving then supported his mother, brother, and himself, mainly by tutoring. He graduated first in his class with a BA degree in 1888, having also been elected as a member of the Skull and Bones society.[15]: 14

In 1891, Fisher received the first PhD in economics granted by Yale.[16] His faculty advisors were the theoretical physicist Willard Gibbs and the sociologist William Graham Sumner. As a student, Fisher had shown particular talent and inclination for mathematics, but he found that economics offered greater scope for his ambition and social concerns. His thesis, published by Yale in 1892 as Mathematical Investigations in the Theory of Value and Prices, was a rigorous development of the theory of general equilibrium. When he began writing the thesis, Fisher had not been aware that Léon Walras and his continental European disciples had already covered similar ground. Nonetheless, Fisher's work was a very significant contribution and was immediately recognized and praised as first-rate by such European masters as Francis Edgeworth.

After graduating from Yale, Fisher studied in Berlin and Paris. From 1890 onward, he remained at Yale, first as a tutor, then after 1898 as a professor of political economy, and after 1935 as professor emeritus. He edited the Yale Review from 1896 to 1910 and was active in many learned societies, institutes, and welfare organizations. He was elected to the American Academy of Arts and Sciences in 1912.[17] He was president of the American Economic Association in 1918. He was elected to the American Philosophical Society in 1927.[18] The American Mathematical Society selected him as its Gibbs Lecturer for 1929.[19] A leading early proponent of econometrics, in 1930 he founded, with Ragnar Frisch and Charles F. Roos the Econometric Society, of which he was the first president.

Fisher was a prolific writer, producing journalism as well as technical books and articles, and addressing various social issues surrounding the First World War, the prosperous 1920s and the depressed 1930s. He made several practical inventions, the most notable of which was an "index visible filing system" which he patented in 1913[20] and sold to Kardex Rand (later Remington Rand) in 1925. This, and his subsequent stock investments, made him a wealthy man until his personal finances were badly hit by the Crash of 1929.[21]

Fisher was also an active social and health campaigner, as well as an advocate of vegetarianism, prohibition, and eugenics.[22] In 1893, he married Margaret Hazard, a granddaughter of Rhode Island industrialist and social reformer Rowland G. Hazard.[1] He died of inoperable colon cancer[23] in New York City in 1947, at the age of 80.[1]

Economic theories[edit]

Utility theory[edit]

James Tobin, writing on the contributions of John Bates Clark and Irving Fisher to neoclassical theory in America[24] argues that American economists contributed in their own way to the preparation of a common ground after the neoclassical revolution. In particular Clark and Irving Fisher "brought neoclassical theory into American journals, classrooms, and textbooks, and its analytical tools into the kits of researchers and practitioners." Already in his doctoral thesis, "Fisher expounds thoroughly the mathematics of utility functions and their maximization, and he is careful to allow for corner solutions." Already then, Fisher "states clearly that neither interpersonally comparable utility nor cardinal utility for each individual is necessary to the determination of equilibrium."

In reviewing the history of utility theory, economist George Stigler wrote that Fisher's doctoral thesis had been "brilliant" and stressed that it contained "the first careful examination of the measurability of the utility function and its relevance to demand theory."[7] While his published work exhibited an unusual degree of mathematical sophistication for an economist of his day, Fisher always sought to bring his analysis to life and to present his theories as lucidly as possible. For instance, to complement the arguments in his doctoral thesis, he built an elaborate hydraulic machine with pumps and levers, allowing him to demonstrate visually how the equilibrium prices in the market adjusted in response to changes in supply or demand.

Stock market crash of 1929[edit]

The stock market crash of 1929 and the subsequent Great Depression cost Fisher much of his personal wealth and academic reputation. He famously predicted, nine days before the crash, that stock prices had "reached what looks like a permanently high plateau."[32] Irving Fisher stated on October 21 that the market was "only shaking out of the lunatic fringe" and went on to explain why he felt the prices still had not caught up with their real value and should go much higher. On Wednesday, October 23, he announced in a banker's meeting "security values in most instances were not inflated." For months after the Crash, he continued to assure investors that a recovery was just around the corner. Once the Great Depression was in full force, he did warn that the ongoing drastic deflation was the cause of the disastrous cascading insolvencies then plaguing the American economy because deflation increased the real value of debts fixed in dollar terms. Fisher was so discredited by his 1929 pronouncements and by the failure of a firm he had started that few people took notice of his "debt-deflation" analysis of the Depression. People instead eagerly turned to the ideas of Keynes. Fisher's debt-deflation scenario has since seen a revival since the 1980s.

Constructive Income Taxation[edit]

Lawrence Lokken, the University of Miami School of Law professor of economics, credits [33] Fisher's 1942 book with the concept behind the Unlimited Savings Accumulation Tax, a reform introduced in the United States Senate in 1995 by Senator Pete Domenici (R-New Mexico), former Senator Sam Nunn (D-Georgia), and Senator Bob Kerrey (D-Nebraska). The concept was that unnecessary spending (which is hard to define in a law) can be taxed by taxing income minus all net investments and savings, and minus an allowance for essential purchases, thus making funds available for investment.

Social and health campaigns[edit]

In 1898, Fisher was diagnosed with tuberculosis, the same disease that had killed his father. He spent three years in sanatoria, finally making a full recovery. That experience sparked in him a vocation as a health campaigner. He was one of the founders of the Life Extension Institute, under whose auspices he co-authored the bestselling book How to Live: Rules for Healthful Living Based on Modern Science, published in 1915. He advocated regular exercise and the avoidance of red meat, tobacco, and alcohol. In 1924, Fisher wrote an anti-smoking article for the Reader's Digest, which argued that "tobacco lowers the whole tone of the body and decreases its vital power and resistance ... [it] acts like a narcotic poison, like opium and like alcohol, though usually in a less degree".[34]

Fisher supported the legal prohibition of alcohol and wrote three booklets defending prohibition in the United States on grounds of public health and economic productivity.[35] As a proponent of Eugenics he helped found the Race Betterment Foundation in 1906. He also defended eugenics, serving in the scientific advisory board of the Eugenics Record Office and as first president of the American Eugenics Society.[36]

When his daughter Margaret was diagnosed with schizophrenia, Fisher had her treated at the New Jersey State Hospital at Trenton, whose director was the psychiatrist Henry Cotton. Cotton believed in a "focal sepsis" theory, according to which mental illness resulted from infectious material in the roots of teeth, bowel recesses, and other places in the body. Cotton also claimed that surgical removal of the infected tissue could alleviate the patient's mental disorder. At Trenton, Margaret Fisher had sections of her bowel and colon removed, which eventually resulted in her death. Irving Fisher nonetheless remained convinced of the validity of Cotton's treatment.[37]

Fisher, Irving Norton, 1961. A Bibliography of the Writings of Irving Fisher (1961). Compiled by Fisher's son; contains 2425 entries.