Panic of 1857

The Panic of 1857 was a financial crisis in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States.[1] The world economy was more interconnected by the 1850s, which made the Panic of 1857 the first worldwide economic crisis.[2] In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain.[3]

Beginning in September 1857, the financial downturn did not last long, but a proper recovery was not seen until the onset of the American Civil War in 1861.[4] The sinking of SS Central America in September 1857 contributed to the panic, since New York City banks were waiting on a much-needed shipment of gold that was being transported by the ship. After the failure of Ohio Life Insurance and Trust Company, the financial panic quickly spread with businesses beginning to fail, the railroad industry experiencing financial declines, and hundreds of thousands of workers being laid off.[5]

Because the years immediately preceding the Panic of 1857 were prosperous, many banks, merchants, and farmers had seized the opportunity to take risks with their investments, and, as soon as market prices began to fall, they quickly began to experience the effects of financial panic.[4] American banks did not recover until after the Civil War.[6]

Background[edit]

The early 1850s saw great economic prosperity in the United States, stimulated by the large amount of gold mined in the California Gold Rush that greatly expanded the money supply. By the mid-1850s, the amount of gold mined began to decline, causing western bankers and investors to become wary. Eastern banks became cautious with their loans in the eastern US, and some even refused to accept paper currencies issued by western banks.[7]

The US Supreme Court decided Dred Scott v. Sandford in March 1857. After the enslaved man Dred Scott sued for his freedom, Chief Justice Roger Taney ruled that Scott was not a citizen because he was Black, and so did not have the right to sue in court. Taney also called the Missouri Compromise unconstitutional and said that the federal government could not prohibit slavery in US territories. The decision had a significant impact on the development of the western territories.[8] Soon after the decision, "the political struggle between 'free soil' and slavery in the territories" began.[9]

The western territories north of the Missouri Compromise line were now opened to the expansion of slavery, which would obviously have drastic financial and political effects: "Kansas land warrants and western railroad securities' prices declined slightly just after the Dred Scott decision in early March."[8] This fluctuation in railroad securities proved "that political news about future territories called the tune in the land and railroad securities markets".[8]

Before 1857, the railroad industry had been booming due to large migrations of people to the west, especially to Kansas. The large influx of people made the railroads a profitable industry, and the banks began to provide railroad companies with large loans. Many of the companies never made it past the stage of a paper railroad and never owned the physical assets necessary to run a real one. Prices of railroad stocks as a whole began to experience a stock bubble, and railroad stocks saw increasingly-speculative entries into the fray, worsening the bubble. In the meantime, the Dred Scott decision lent uncertainty to railroads in general.

Failure of Ohio Life Insurance and Trust Company[edit]

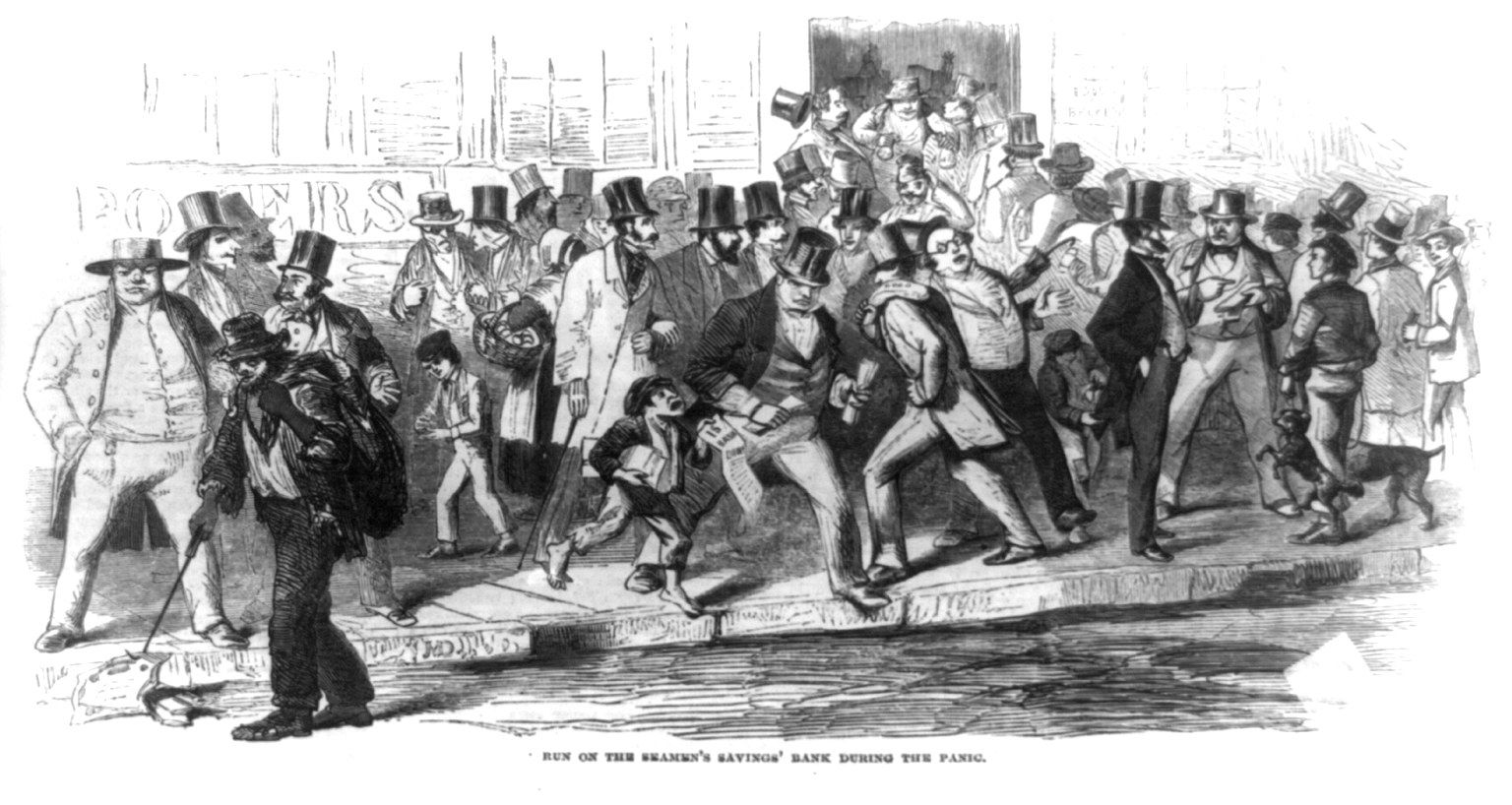

On the morning of August 24, 1857, the president of Ohio Life Insurance and Trust Company announced that its New York branch had suspended payments.[13] The company, an Ohio-based bank with a second main office in New York City, had large mortgage holdings and was the liaison to other Ohio investment banks. Ohio Life went bankrupt because of fraudulent activities by the company's management, which threatened to precipitate the failure of other Ohio banks or, even worse, to create a run on the banks.[14]

In an article printed in the New York Daily Times, Ohio Life's "New York City and Cincinnati [branches were] suspended; with liabilities, it is said, of $7,000,000".[15] The banks connected to Ohio Life were reimbursed and "avoided suspending convertibility by credibly coinsuring one another against runs".[16] The failure of Ohio Life brought attention to the financial state of the railroad industry and land markets and caused the financial panic to become more public.[17]

Results[edit]

The result of the Panic of 1857 was that the largely-agrarian southern economy, which had few railroads, suffered little, but the northern economy took a significant hit and made a slow recovery. The area affected the most by the Panic was the Great Lakes region, and the troubles of that region were "quickly passed to those enterprises in the East that depended upon western sales".[25] After approximately a year, much of the economy in the North and the entire South had recovered from the Panic.[26]

By the end of the Panic, in 1859, tensions between the North and South regarding the issue of slavery in the United States were increasing. The Panic of 1857 encouraged those in the South who believed the North needed the South to keep a stabilized economy, and southern threats of secession were temporarily quelled. Southerners believed that the Panic of 1857 made the North "more amenable to southern demands" and would help to keep slavery alive in the United States.[25]

According to Kathryn Teresa Long, the religious revival of 1857–1858 led by Jeremiah Lanphier began among New York City businessmen in the early months of the Panic.[27]

Crisis in the United Kingdom[edit]

News of the crisis in America caused runs on the banks in Glasgow, Liverpool, and London. The Borough Bank of Liverpool closed its doors on October 27, 1857, and the Western Bank of Scotland failed on November 9 as did the City of Glasgow Bank two days later.[28]: 189–191 The government was forced to suspend the Bank Charter Act of 1844 again on November 12.[28]: 191

The bullion in the Bank of England started increasing soon after, but unlike the Panic of 1847, the suspension was required this time for the British currency to remain legal and convertible under the Bank Charter Act 1844. The fiduciary issue was temporarily increased to the extent of £2 million and was used between November 18 and December 23, 1857.[28]